surrender green card exit tax

Surrendering a Green Card US Tax Rules for LTRs. Only at 29 million does the exit tax begin to take effect 29 million 238 690k.

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

You can surrender a Green Card without triggers any exit or departure tax.

. Lets talk about the exit tax implications of the treaty election by this green card holder to be treated as a nonresident of the United States for income tax purposes. In addition to the Exit Tax US recipients of any gift or bequest at any time in the future from the covered expatriate will be hit with a special transfer tax upon receiving that. Here are 4 ways we can help you - 1.

Citizen Immigration Service USCIS determines that you have. When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents.

This can mean that green card holders who have not formerly surrendered the green card are stuck. Tax planning years in advance does help the exit process. Hello Can you please advice on pre-requisites to green card surrender.

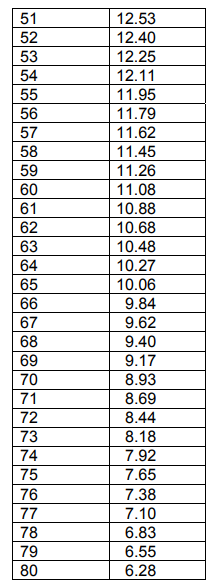

You can reduce the first 693k of gains for 2016 so there would be no tax to pay. Surrender Green Card after 8 Years When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed distribution. Nothing is better than a clean heads-up from the US tax system at the time of exit.

Citizenship or Green Card is on the rise and if youre one whos planning your exit strategy theres a big factor you should consider. Currently net capital gains can be taxed as high as 238. Green Card Exit Tax 8 Years Tax Implications at Surrender.

Some comments on the exit tax. Even though you may have surrendered your. Two of the three.

This can mean that green card holders who. Green card holders are required to adhere to US tax laws. If however you have had permanent residence for more than 8 of the last 15 years and your assets exceed 2.

Does one have to close bank accounts. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. The process of abandonment can be initiated by a green card holder US consular officer or US immigration.

Its critically important to understand that Green Card holders who are long term residents may be subject to the 877A expatriation tax if they surrender their Green Card. Citizenship and Immigration Service USCIS must send you documentation that states your. If you need InternationalTax advice.

Does one need to finish all tax filing. Foreign nationals are required to file US expatriate tax returns even if their green. You can surrender your green card but that doesnt mean you are tax exempt.

The number of Americans wanting to renounce their US. SIGN UP for free webinars on US Expat Taxes and International. Is there an exit tax upon surrendering the card 3.

Todays blog post examines the US tax issues that surround relinquishing the green card especially at the point of entry when circumstances are not ideal for tax planning.

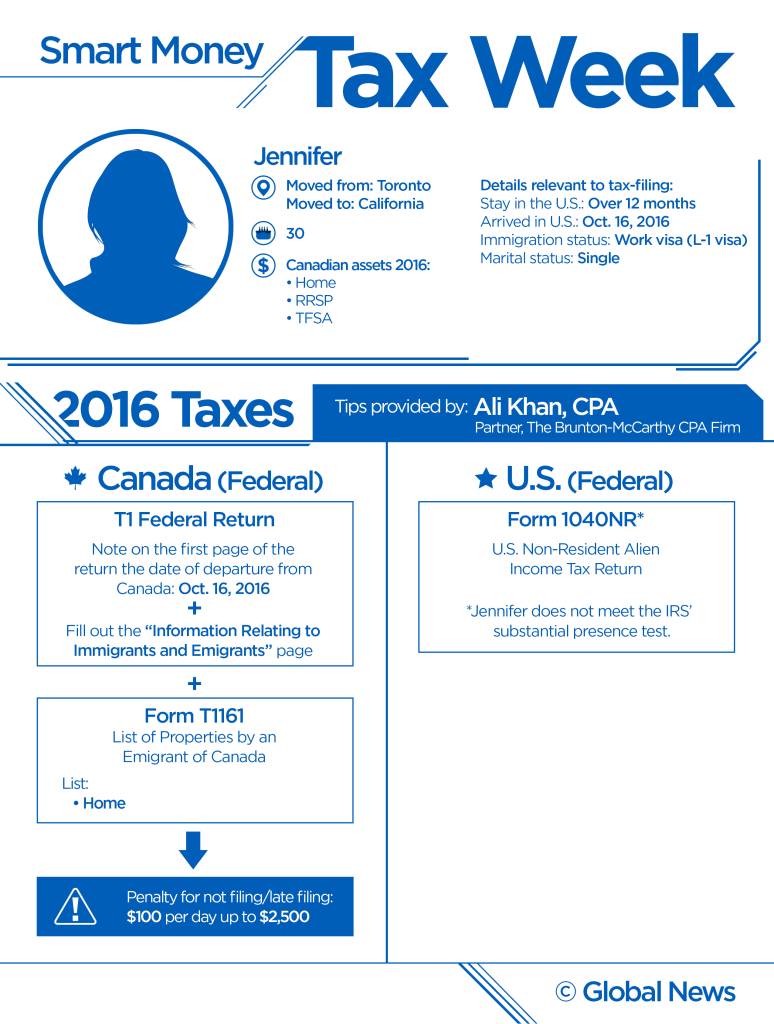

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Form I 407 How To Prepare To Give Up Permanent Residency

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Webinar Is Now The Time To Renounce Your Us Citizenship Moodys Private Client

Re Entry Permits For Green Card Holders Explained

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

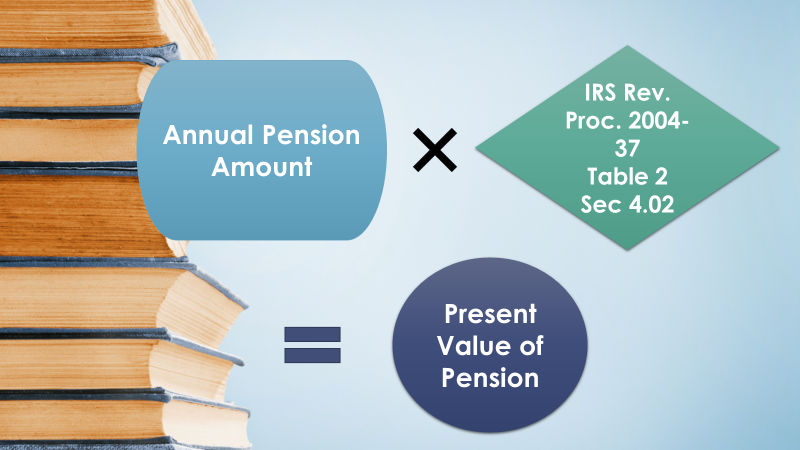

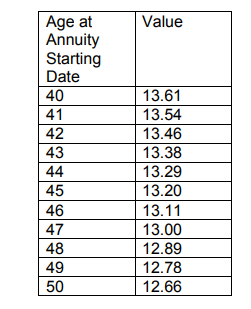

Valuation Of Defined Benefit Pension Plan In Exit Tax Cdh

Renouncing Us Citizenship All You Need To Know Wise Formerly Transferwise

Form I 407 How To Prepare To Give Up Permanent Residency

Re Entry Permits For Green Card Holders Explained

Valuation Of Defined Benefit Pension Plan In Exit Tax Cdh

Expats Face Steep Exit Tax Courtesy Of Facebook

Nonresidents Think You Are Safe From U S Gift And Estate Taxes Think Again The Wolf Group

How To Apply For U S Citizenship And How To Renounce It

Frequently Asked Questions About The Us Tax Consequences Of Holding A Us Green Card And Surrendering One

Valuation Of Defined Benefit Pension Plan In Exit Tax Cdh

Renouncing Us Citizenship All You Need To Know Wise Formerly Transferwise

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals