georgia estate tax rate 2020

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Tax Rates Gordon County Government

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

. Georgia estate tax rate 2020. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

NOTICE OF PROPERTY TAX INCREASE June 16 2020. Share This Story. Estate Tax - FAQ.

Combined state and local sales taxes. A On and after July 1 2014 there shall be no estate taxes levied by the state and no estate tax returns shall be required by the. On August 5 the Fulton County Board of Commissioners voted to reduce its millage rate for the sixth consecutive year.

General Rate Chart - Effective July 1 2020 through September 30. What are my Payment Options. 2020 Georgia Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

The top Georgia tax rate has decreased from 575 to 55 while the tax brackets are unchanged from last year. 087 average effective rate. Georgia estate tax rate 2020.

48-12-1 was added to read as follows. General Rate Chart - Effective April 1 2022 through June 30 2022 2219 KB. Does Georgia have an estate tax.

Georgia Tax Center Help Individual Income Taxes Register New Business. 2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years -. Property Tax Rates for Overlapping Governments per 1000 of Assessed Value 2020-1985 Actual.

As of July 1st 2014 OCGA. Georgia is ranked number thirty three out of the fifty states in order of the average amount of property. Historical tax rates are available.

Elimination of estate taxes and returns. The Chatham County Board of Commissioners has tentatively adopted a millage rate which will require an increase in property taxes by 181 percent in General Maintenance and Operations taxes an increase in property taxes by 229 percent in Special Service District taxes and 150 percent in Chatham. Tax amount varies by county.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. Property Taxes in Georgia. Even though there is no state estate tax in georgia you may still owe money to the federal government.

States Georgias tax system ranks close to the middle of the pack for the burden its tax system places on taxpayers. The tax cuts and jobs act signed into law in 2017 doubled the exemption for the federal estate tax and indexed that exemption to inflation. GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County District MO Bond BANKS SCHOOL 14511 BANKS STATE 0000 BARROW AUBURN - BARROW 4931 BARROW BETHLEHEM 0000 BARROW BRASELTON 0000 BARROW CARL 0000 BARROW CID.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Then you take the 1158 million number. The Georgia County Ad Valorem Tax Digest Millage Rates have the actual millage rates for each taxing jurisdiction.

In general property taxes in the Peach State are relatively low. The federal estate tax exemption is 1170 million in 2021 going up to 1206 million for 2022. Property Tax Homestead Exemptions.

Fulton County has consistently reduced its millage rate while maintaining a strong credit rating and. Sales Tax Rates - General. Property Tax Returns and Payment.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors. Unclaimed Property About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences. The median real estate tax payment in Georgia is 1771 per year which is around 800 less than the 2578 national mark.

083 of home value. The average effective property tax rate is 087. The sale use storage or consumption of energy which is necessary and integral to the manufacture of tangible personal property at a manufacturing plant in this state shall be exempt.

The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Prior taxable years not applicable. From Fisher Investments 40 years managing money and helping thousands of families.

Outlook for the 2021 Georgia income tax rate is for the top tax rate to decrease further or change to a. Georgia Individual Income Tax is based on the taxpayers federal adjusted gross income adjustments that are required by Georgia law and the taxpayers filing requirements. Georgia is ranked number thirty three out of the fifty states in.

The approved 2020 General Fund millage rate of 9776 mills represents a decrease from 9899 mills in 2019 and is revenue neutral. Georgia Tax Center Help Individual Income Taxes Register New Business. 2 the top tax rate is 12.

Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. In a county where the millage rate is 25 mills the property tax on that house would be 1000. Search for income tax statutes by keyword in the Official Code of Georgia.

Even though there is no state estate tax in Georgia you may still owe money to the federal government. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. 2790 cents per gallon of regular gasoline 3130 cents per gallon of diesel.

County Property Tax Facts. Property Tax Millage Rates. Georgia income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020.

Its important to keep in mind though that property taxes in Georgia vary greatly between locations.

Georgia Inheritance Laws What You Should Know Smartasset

Georgia Paycheck Calculator Smartasset

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Va Real Estate Investing Rental Property Buying First Home Home Buying Process

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Georgia Sales Tax Small Business Guide Truic

State Income Tax Rates And Brackets 2022 Tax Foundation

Georgia Retirement Tax Friendliness Smartasset

Tax Rates Gordon County Government

2021 Property Tax Bills Sent Out Cobb County Georgia

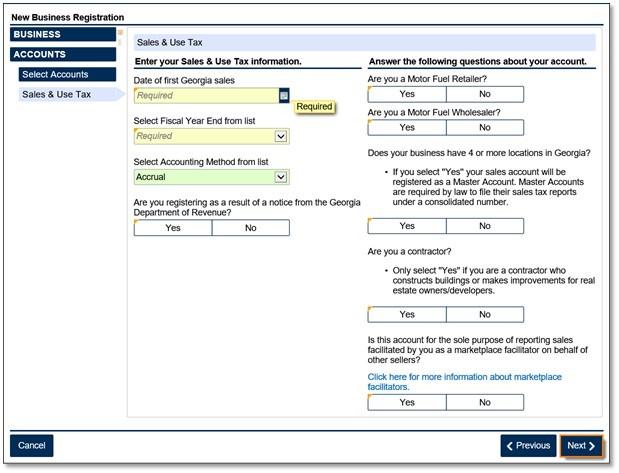

Marketplace Facilitators Georgia Department Of Revenue

Georgia Listed As A Tax Friendly State For Retirees

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation